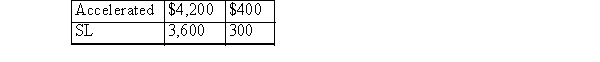

A firm changes from accelerated depreciation to straight-line depreciation in 20x1: Depreciation: Total before 20x1:  Provide the 20x1 entries to record the accounting change and to record 20x1 depreciation expense, ignoring taxes.

Provide the 20x1 entries to record the accounting change and to record 20x1 depreciation expense, ignoring taxes.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q136: An asset that cost $9,000 on January

Q137: The following errors were discovered in the

Q138: Ending inventory for 20x0 is overstated in

Q139: Early adoption of involuntary changes in accounting

Q140: A change in policy mandated by a

Q142: The records of CDF reflected the following

Q143: An asset cost $190,000; it is being

Q144: Listed below are a number of errors.Indicate

Q145: KEC has a machine that cost $75,000

Q146: Indicate how the following errors would affect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents