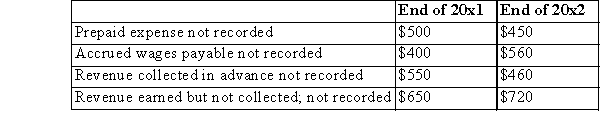

The following errors were discovered during 20x3:  Therefore, the pre-tax income for 20x2 was Overstated or Understated by $_ .

Therefore, the pre-tax income for 20x2 was Overstated or Understated by $_ .

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q145: KEC has a machine that cost $75,000

Q146: Indicate how the following errors would affect

Q147: An asset that cost $49,500 was being

Q148: On January 1, 2014, Ryan Ltd.purchased equipment

Q149: On January 1, 20x1, DB purchased equipment

Q151: Following are five separate and completely independent

Q152: Depreciation expense for the most recent fiscal

Q153: Give the correct response to each of

Q154: In 20x1, an asset was purchased for

Q155: ABC Inc.is a publicly traded enterprise.The following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents