On January 1, 2014, CDE Company leased an asset from LMN which originally cost the lessor $75,000.The lease agreement was an operating lease and specified that three $10,500 annual rentals were to be paid at the beginning of each year.LMN should make the following entry on January 1, 2014:

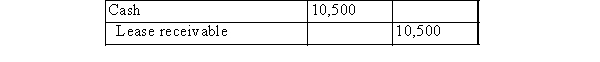

A) Please see the following table:

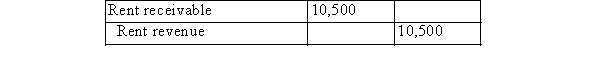

B) Please see the following table:

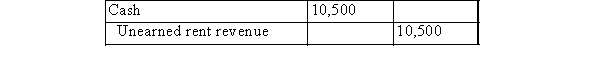

C) Please see the following table:

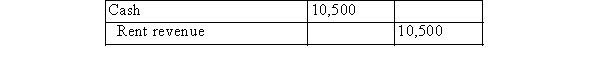

D) Please see the following table:

Correct Answer:

Verified

Q2: On December 31, 2015, JKL leased a

Q3: On January 1st, 2014, ABC Inc.(the lessor)agrees

Q4: Lease Y contains a bargain purchase option

Q5: The amount of finance revenue to be

Q6: Choose the correct statement regarding including the

Q8: In a sale and leaseback situation:

A)the lessor

Q9: On December 10, 2014, LMN purchased a

Q10: The straight-line method is frequently used to

Q11: Amanda Company leased an office building for

Q12: A bargain purchase option in a finance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents