On January 1, 2014, ABC INC.leased a machine to MNO.The lease was for a 10-year period, which approximated the useful life of the machine.ABC INC.purchased the machine for $120,000 and expects to earn a 10 percent return on its investment, based upon an annual rental of $17,754 payable in advance each January 1st.Assuming that the lease was a direct financing lease, what should be the interest entry on ABC INC.'s books on December 31, 2014?

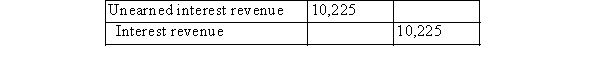

A) Please see the following table:

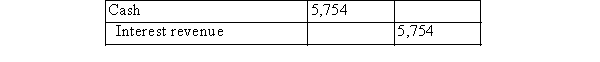

B) Please see the following table:

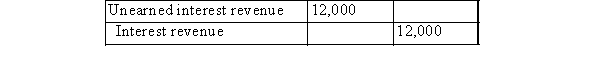

C) Please see the following table:

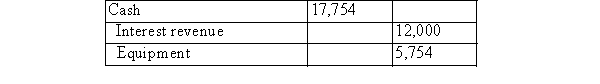

D) Please see the following table:

Correct Answer:

Verified

Q33: The depreciation period used by the lessee

Q34: If a lessee does not exercise a

Q35: A 5-year lease contract is signed on

Q36: LAS owns a building in North Bay.LAS

Q37: A lessee is attempting to circumvent the

Q39: The inception of a lease is 1/1/x1.A

Q40: Initial direct costs include lessor costs incurred:

A)after

Q41: While only certain leases are currently accounted

Q42: The estimated residual value of a depreciable

Q43: RST entered into a direct financing lease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents