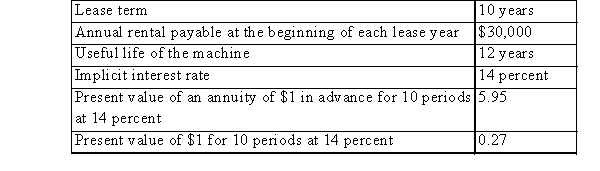

ABC INC.leased a new machine from QRS on July 1, 2014, under a lease with the following pertinent information:  ABC INC.has the option to purchase the machine at the end of the lease term, by paying $40,000, which approximates the expected fair value of the machine on the option exercise date.The cost of the machine on QRS's accounting records is $150,000.On July 1, 2014, ABC INC.should record a net capitalized leased asset of:

ABC INC.has the option to purchase the machine at the end of the lease term, by paying $40,000, which approximates the expected fair value of the machine on the option exercise date.The cost of the machine on QRS's accounting records is $150,000.On July 1, 2014, ABC INC.should record a net capitalized leased asset of:

A) $178,500

B) $190,000

C) $150,000

D) $189,300

Correct Answer:

Verified

Q54: XYZ agreed to lease an industrial machine

Q55: If the title to a leased asset

Q56: In a sale and leaseback situation

A)the lessee

Q57: For the lessor, under a sales-type lease,

Q58: ABC INC.entered into a sales-type lease to

Q60: The term usually used to describe the

Q61: LAS owns a building in North Bay.LAS

Q62: LMN made the following journal entry relating

Q63: RST entered into a sales-type lease with

Q64: The basic accounting issue for lessors is:

A)revenue

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents