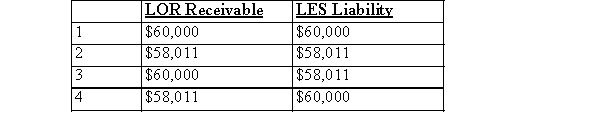

On January 1, 2014, LOR leased a machine (original cost $60,000) to LES for a 5-year period at an implicit interest rate of 15 percent.The lease qualified as a direct financing lease and the annual lease payments ($17,306) are made each December 31.LOR retained the $4,000 estimated unguaranteed residual value , LOR's net receivable and LES's liability would be (round to the nearest dollar) :

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q75: A lease agreement includes the following provisions:

Q76: Under a finance lease that includes a

Q77: The amount of each rental payment on

Q78: On January 1st, 2014, ABC Inc.(the lessor)agrees

Q79: When the lessee guarantees the residual value

Q81: When the lessee guarantees only a portion

Q82: If the lessor records unearned rent at

Q83: When the lessee guarantees the residual value

Q84: Under a sales-type lease, the difference between

Q85: The appropriate valuation of an operating lease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents