On January 1, 2014, WXY signed an operating lease agreement, which required $5,800 annual rentals to be paid at the end of each year.The accounting period ends December 31.At the end of 2014, WXY (lessee) should make the following entry:

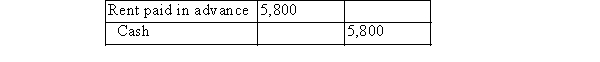

A) Please see the following table:

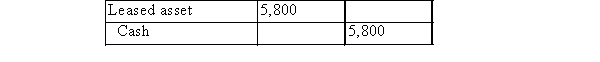

B) Please see the following table:

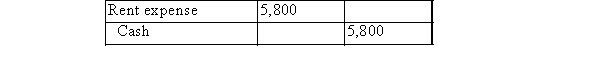

C) Please see the following table:

D) Please see the following table:

Correct Answer:

Verified

Q94: All of the following are methods of

Q95: LAS owns a building in North Bay.LAS

Q96: In a sale and leaseback arrangement, the

Q97: If the residual value of a leased

Q98: Amanda Company leased an office building for

Q100: A company became a lessee by leasing

Q101: When a non-refundable down payment on a

Q102: Initial direct costs are:

A)non-refundable down payments made

Q103: JKL leased an asset to RST that

Q104: Executory costs include:

A)insurance premiums.

B)leasehold improvements.

C)finance expense incurred.

D)annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents