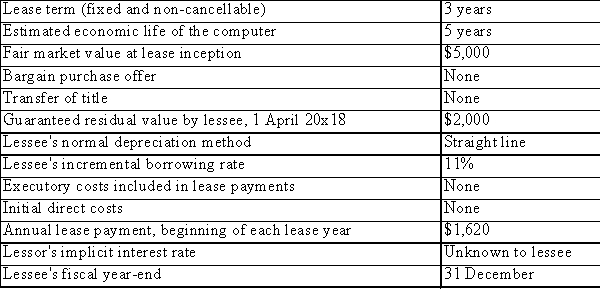

ABC Inc.leased a computer to the Lennox Silver Company on 1 April 2018.The terms of the lease are as follows:  *** ABC Inc.company charges a half-year depreciation in the year of acquisition and a half-year in the year of disposition, regardless of the actual dates of acquisition and disposal.

*** ABC Inc.company charges a half-year depreciation in the year of acquisition and a half-year in the year of disposition, regardless of the actual dates of acquisition and disposal.

Suppose that at the end of the lease, the lessor tells the lessee to dispose of the asset, and to keep any proceeds in excess of the guaranteed residual value.Provide entries for the lessee on 1 April 2014, assuming that the lessee sells the asset for $2,100 and remits the required $2,000 payment to the lessor.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q191: What is a sales-type lease?

Q192: Ryan Corp.enters into an agreement with Montgomery

Q193: You are analyzing the balance sheet of

Q194: On January 1, 2014, TA acquired a

Q195: Ryan Corp.enters into a finance lease agreement

Q197: The following information relates to a lease

Q198: In order for a lessee to capitalize

Q199: Explain what is meant by off-balance sheet

Q200: Company A enters into a lease agreement

Q201: Ryan Corp.enters into an agreement with Montgomery

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents