On January 1, 2014, LOR Company rented a machine (3-year life, no residual value, straight-line)to LEE Company for a cash rental payable each December 31, 20 11, 12, and x13.The rental is based on the regular sales price: cost, $35,665; sale price, $45,665.The agreed interest rate was 15% and the lessee retains the machine at the end of the lease term at no additional cost.

(a)The annual rental is $ _.

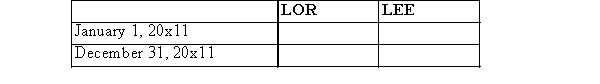

(b)Complete the following lease amortization schedule:  (c)Give the lessor's and lessee's entries on the following dates:

(c)Give the lessor's and lessee's entries on the following dates:

Correct Answer:

Verified

Q200: Company A enters into a lease agreement

Q201: Ryan Corp.enters into an agreement with Montgomery

Q202: What is the interest rate used for

Q203: Ryan Corp.leased an asset from Amanda Corp.under

Q204: Ryan Corp.is a manufacturer of high tech

Q206: If lessor has property that has a

Q207: ML leased a computer to LH on

Q208: Ryan Corp.is a manufacturer of high tech

Q209: What guidelines are used under IFRS to

Q210: Why is the gross method used by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents