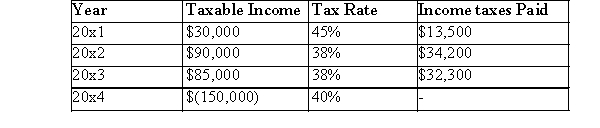

The following information for JG Corporation is available:  JG carries applies its tax losses sequentially, that is, tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

JG carries applies its tax losses sequentially, that is, tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

A) $46,600.

B) $59,100.

C) $52,660.

D) $48,600.

Correct Answer:

Verified

Q1: In 2013, JMR Corp.set up a deferred

Q2: The following information for KAR Corporation is

Q3: The following information pertains to XYZ Inc.:

Q4: A tax benefit represents:

A)the amount of refund

Q6: The following information pertains to ABC Inc.:

Q7: Geisler Corp.provided you with the following information

Q8: JG Corporation incurred a tax loss of

Q9: What factor would most likely cause a

Q10: FGH had a $1,200 temporary difference for

Q11: A Corporation that incurs a taxable loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents