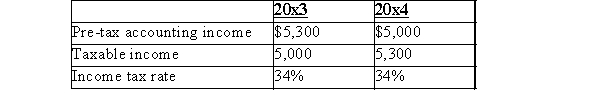

CJM provided the following data related to income tax allocation:  The deferred income tax account showed a zero balance at the start of 2013.There was only one temporary difference, an expense, which was deductible for tax purposes in 2013, but was recorded for accounting purposes in 2014.There are no carry backs or carry forwards and no originating temporary differences in 2014.The journal entry to record the income tax consequences for 2014 would include a:

The deferred income tax account showed a zero balance at the start of 2013.There was only one temporary difference, an expense, which was deductible for tax purposes in 2013, but was recorded for accounting purposes in 2014.There are no carry backs or carry forwards and no originating temporary differences in 2014.The journal entry to record the income tax consequences for 2014 would include a:

A) Debit of $102 to CJM's deferred income tax asset account.

B) Credit of $102 to CJM's deferred income tax liability account.

C) Debit of $102 to CJM's deferred income tax liability account.

D) Credit of $102 to CJM's deferred income tax asset account.

Correct Answer:

Verified

Q40: The following data represents the complete taxable

Q41: Carry back and carry forward procedures for

Q42: All of the following are evidence to

Q43: Reducing CCA is one tax strategy that

Q44: The use of a valuation allowance account

Q46: Companies normally apply tax loss carry backs

Q47: IFRS requires that any Valuation Allowance account

Q48: Once it is deemed that a potential

Q49: Under income tax laws and regulations a

Q50: The following data represents the complete taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents