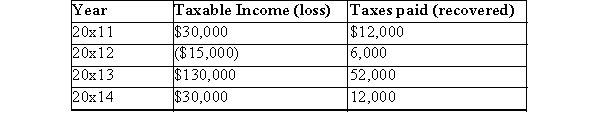

KAR Ltd.has been in business for five years and incurs a loss of $320,000 in 20x15.The company has no temporary differences.The history of the company's earnings since they began operations is a follows:  The tax rate has been constant at 40%.Required:

The tax rate has been constant at 40%.Required:

Prepare journal entries to record the recovery of taxes and any journal entries necessary for any loss carry forwards.Assume probability of recovery is less than 50%

Correct Answer:

Verified

N...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: What options are open to a company

Q83: How can a company use CCA to

Q84: JMR's taxable income for the first five

Q85: JG Ltd.has been in business for five

Q86: Once a deferred benefit of a tax

Q88: AG's taxable income for the first five

Q89: KAR's taxable income for the first five

Q90: JG Ltd.has been in business for five

Q91: How does the existence of a loss

Q92: Financial information related to Unip Limited's ("UL")2013

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents