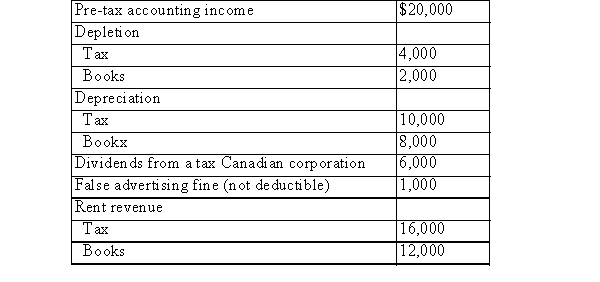

The following data of ABC Ltd.relates to the current year:  Compute taxable income for the year.

Compute taxable income for the year.

A) $13,000

B) $17,000

C) $19,000

D) $11,000

E) $15,000

Correct Answer:

Verified

Q1: KER commenced operations in 2013.The company had

Q3: Kate Corporation sold a truck resulting in

Q4: All of the following are all justifications

Q5: Temporary differences can be dealt with in

Q6: JMR Corporation has one asset worth $350,000.Depreciation

Q7: The Harry Company reported for pre-tax income

Q8: Amanda Corporation incurred $10,000 of meals and

Q9: The following information is available for Ryan

Q10: Which of the following is an example

Q11: KER commenced operations in 2013.The company has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents