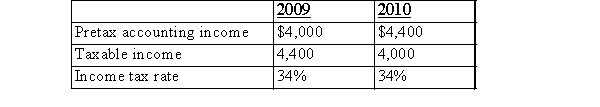

STR provided the following data related to income tax allocation:  The deferred tax account showed a zero balance at the start of 2009.There was only one temporary difference, a revenue amount, which was taxable in 2009, but was recorded for accounting purposes in 2010.There are no carry backs or carry forwards.The journal entry to record the income tax consequences for 2009 would include a:

The deferred tax account showed a zero balance at the start of 2009.There was only one temporary difference, a revenue amount, which was taxable in 2009, but was recorded for accounting purposes in 2010.There are no carry backs or carry forwards.The journal entry to record the income tax consequences for 2009 would include a:

A) Credit of $400 to STR's deferred tax account.

B) Debit of $400 to STR's deferred tax account.

C) Credit of $136 to STR's deferred tax account.

D) Debit of $136 to STR's deferred tax account.

Correct Answer:

Verified

Q25: A characteristic of the taxes payable method

Q26: Golf dues paid for by a company

Q27: An example of a "deductible amount" occurs

Q28: On January 1, Year 2, GHI Inc.had

Q29: EGR Corporation has one asset worth $450,000.Accumulated

Q31: ABC Inc.owns a single capital asset.At the

Q32: The following information is available for Ryan

Q33: KAR Company sold a building resulting in

Q34: Which of the following would result in

Q35: The following information is available for Ryan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents