On January 1st, 20x1, 20,000 units of stock appreciation rights were granted to JKL Inc's 200

employees, each of which received 100 units which accrue evenly over the following three years.The rights allow the employees to receive cash compensation for any stock price increase on December 31st, 20x3, if they are still with the company at that time.

The cash to be distributed is the difference between the fair value of the share and the reference price of $5 per share.Cumulative retention rates are expected to be 80% and 70% for 20x1 and 20x2 respectively.Twenty employees forfeited their rights in 20x1 and thirty forfeited their rights in 20x2.On December 31st, 20x3 there were 150 employees working for JKL Inc.

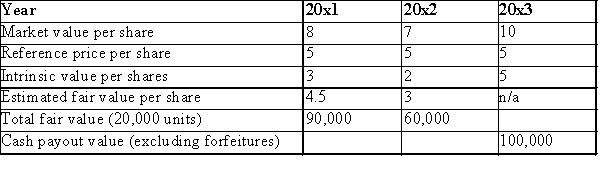

The following data applies to JKL's SARS plan:

Required:

Required:

Prepare the required journal entries for 20x1, 20x2 and 20x3 to record the compensation expense and ultimate cash payout related to the company's SARS plan.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: DWWR Ltd.issues a $150,000, 6%, five-year debenture

Q123: On January 1, 2014, ABC Incorporated issued

Q124: Why do companies issue retractable preferred shares?

Q125: KIM Corp.owned a major business building in

Q126: In substance, a complex financial instrument will

Q128: On April 1, Year 1, ABC Inc.,

Q130: Explain why a company would want to

Q131: KER Corp.issued 150,000 rights allowing the holder

Q132: On January 1, 2014, ABC Incorporated issued

Q210: What is a poison pill?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents