(Adapted from "Problem Eleven" from Chapter Six of previous editions of the textbook)

Alpha Ltd. is a Canadian-controlled private corporation operating a small land-development business 20x2, the company acquired a license to manufacture pre-fab homes and began operations immediate Financial information for the 20x2 taxation year is outlined below:

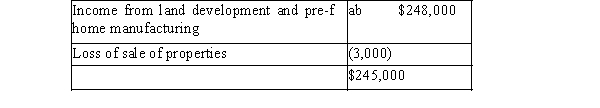

Alpha's profit before income taxes for the year ended November 30, 20x2, was $245,000, as follows:  The loss on sale of property results from two transactions. On October 1, 20x2, Alpha sold all of its s Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.)Also the year, Alpha sold some of its vehicles for $25,000.The vehicles originally cost $50,000 and had a of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

The loss on sale of property results from two transactions. On October 1, 20x2, Alpha sold all of its s Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.)Also the year, Alpha sold some of its vehicles for $25,000.The vehicles originally cost $50,000 and had a of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

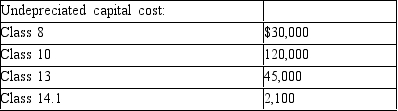

The 20x1 corporate tax return shows the following UCC balances:

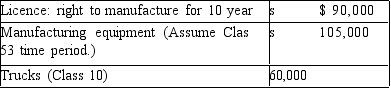

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At th Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time,

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At th Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time,

acquired the following:

Accounting amortization in 20x2 amounted to $60,000.

Accounting amortization in 20x2 amounted to $60,000.

Alpha normally acquires raw land, which it then develops into building lots for resale to individuals contractors. In 20x2, it sold part of its undeveloped land inventory to another developer for $400,000 realized a profit of $80,000, which is included in the land-development income above. The proceeds of $40,000 in cash, with the balance payable in five annual instalments beginning in 20x3.

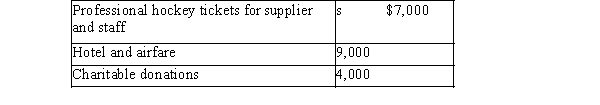

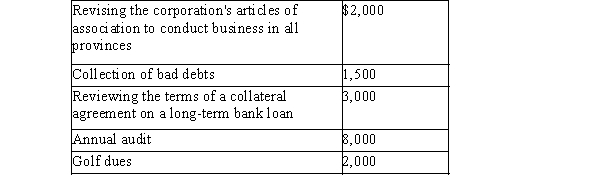

Travel and entertainment expense includes the following:  Legal and accounting expense includes the following:

Legal and accounting expense includes the following:  Required:

Required:

Calculate Alpha's net income for tax purposes for the 20x2 taxation year.

Correct Answer:

Verified

Q1: Which of the following cases is not

Q3: Ben incorporated Miller Co. in 20x7, which

Q4: Green Gardens Inc. purchased a piece of

Q5: ABC Corp. leased an office and paid

Q6: Which of the following situations would not

Q7: Green Business Ltd. (GBL)began operating ten years

Q8: Which of the following statements regarding recapture

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents