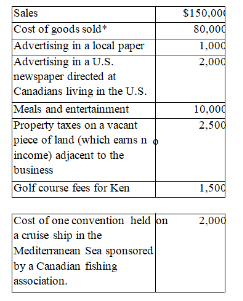

Ken Gray runs a small proprietorship (Ken's Fish)which specializes in fishing gear. He has provided the following information:

(*All inventory is valued at market value.)Required:

A)Calculate the net income for tax purposes for Ken's Fish.

A)would change if Ken had valued his inventory at cost.

B)Explain why any items have been omitted.

C)Briefly discuss how your answer in

Correct Answer:

Verified

Q1: TriStar Industries was recently denied the deduction

Q2: Sam runs a proprietorship that generated $75,000

Q4: Which of the following expenses would be

Q5: A taxpayer recognized a $40,000 loss in

Q5: List the six general limitations to business

Q7: Determine whether the transactions concerning the following

Q8: Joe invested in a piece of land

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents