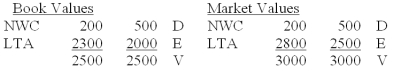

Bombay Company's balance sheet is as follows:

(NWC = net working capital; LTA = long term assets; D = debt; E = equity; V = firm value) :

According to MM's Proposition I corrected for taxes, what will be the change in company value if Bombay issues $200 of equity and uses it to make a permanent reduction in the company's debt? Assume a 35% tax rate.

A) +$140

B) +$70

C) $0

D) -$70

Correct Answer:

Verified

Q4: MM Proposition I with corporate taxes states

Q5: If a corporation cannot use its interest

Q11: The main advantage of debt financing for

Q18: If a firm permanently borrows $100 million

Q18: The relative tax advantage of debt with

Q20: If a firm permanently borrows $50 million

Q22: Which of the following statement(s) about financial

Q24: Corporate tax rate: 34% Personal tax rate

Q30: One of the indirect costs to bankruptcy

Q32: Although the use of debt provides tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents