Southern Merchandising Inc Southern's Tax Rate Is 25 Southern Currently Has $4,000,000 in Shareholder Equity Prior to Any

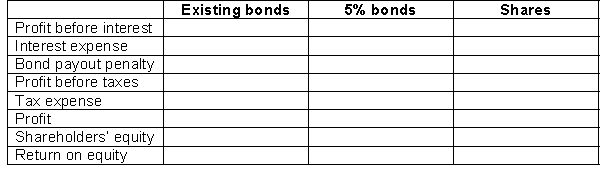

Southern Merchandising Inc. is considering new financing to pay out $2,500,000 of existing 10% bonds payable at the beginning of the next fiscal year. The company wants to maximize ROE in the new year. They are considering two alternative ways of financing the payout:

1. Do not pay out existing bonds;

2. Issue a 5% bond payable at face value, or issue 250,000 common shares at $10.

Other information about Southern:

Southern's tax rate is 25%.

Southern currently has $4,000,000 in shareholder equity prior to any new share issue.

Southern's average profit before financing costs and taxes is $800,000.

A one-time penalty of $150,000 will be incurred to pay out the 10% bonds early, which is fully tax deductible.

Instructions

Calculate the following amounts for Southern, compare the two alternatives to the current bonds payable, and make a recommendation on refinancing, assuming the goal is to maximize return on equity for the next year.

Correct Answer:

Verified

Because Southern's goal is to maximize...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Which of the following statements pertaining to

Q107: Which is one of the main differences

Q108: On February 1, 2014, the Happy Valley

Q109: An increase in the interest coverage ratio

Q110: The board of directors of Finley Corporation

Q112: On January 1, 2013, Andrews Corporation issued

Q113: With both types of instalment notes payable,

Q114: The interest coverage ratio measures the ability

Q115: Three plans for financing a $20,000,000 corporation

Q116: Use the following information for questions :

On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents