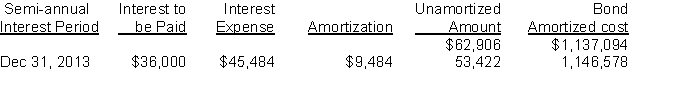

On June 30, 2013, Layton, Inc. sold $1,200,000 (face value) of bonds. The bonds are dated June 30, 2013, pay interest semi-annually on December 31 and June 30, and will mature on June 30, 2016. The following schedule was prepared by the accountant for 2013:  Instructions

Instructions

On the basis of the above information, answer the following questions. (Round your answer to the nearest dollar or percent.)

a. What is the contractual rate of interest for this bond issue?

b. What is the market rate of interest for this bond issue?

c. What was the selling price of the bonds as a percentage of the face value?

d. Prepare the journal entry to record the sale of the bond issue on June 30, 2013.

e. Prepare the journal entry to record the payment of interest and amortization on December 31, 2013.

Correct Answer:

Verified

Q119: United Health is considering two alternatives for

Q120: Asgar Corporation issues a $350,000, 4%, 20-year

Q121: Hanna Manufacturing Limited receives $240,000 on January

Q122: Stead, Inc. issued $600,000, 6%, 20-year bonds

Q123: Presented below are two independent situations:

a. On

Q125: Excerpts from Chung Corporation's Income Statement and

Q126: The following is a summarized balance sheet

Q127: Butler Holdings Inc. issued $400,000 of 20-year,

Q128: On January 1, 2014, LeDrew Corporation issued

Q129: On January 1, 2013, Callahan Corporation issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents