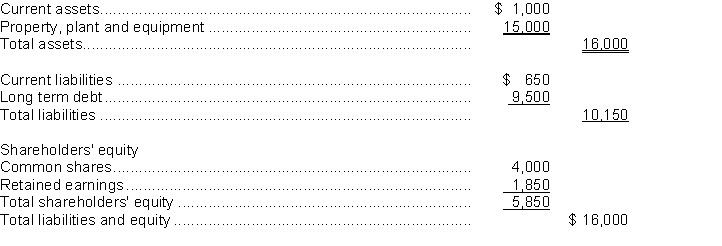

The following is a summarized balance sheet of Falcon Corporation at December 31, 2013. All amounts are in $000's.  Falcon requires additional financing of $5,000,000 to finance an expansion of its business. The two choices are:

Falcon requires additional financing of $5,000,000 to finance an expansion of its business. The two choices are:

Alternative 1: Issue a 20-year, $5,000,000 5% bond payable at face value.

Alternative 2: Issue 250,000 common shares at $20 each.

In Falcon's industry, a safe debt to total assets ratio is considered to be between 50% and 60%. Falcon's board of directors is risk adverse. Assume that the financing is made at the beginning of the year.

Instructions

a. Calculate the debt to total assets ratio under the two proposed financing methods.

b. Make a recommendation to Falcon on the better financing alternative and explain your choice.

Correct Answer:

Verified

Q121: Hanna Manufacturing Limited receives $240,000 on January

Q122: Stead, Inc. issued $600,000, 6%, 20-year bonds

Q123: Presented below are two independent situations:

a. On

Q124: On June 30, 2013, Layton, Inc. sold

Q125: Excerpts from Chung Corporation's Income Statement and

Q127: Butler Holdings Inc. issued $400,000 of 20-year,

Q128: On January 1, 2014, LeDrew Corporation issued

Q129: On January 1, 2013, Callahan Corporation issued

Q130: On July 1, 2014, Jasper Distributors Inc.

Q131: Roblin Manufacturing Inc. intends to finance the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents