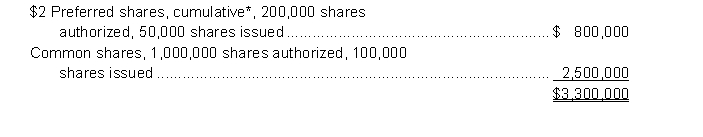

At July 1, 2013, Peters Corporation had the following share capital:  *The preferred dividends are 2 years in arrears.

*The preferred dividends are 2 years in arrears.

On January 1, 2014, the board of directors declared and paid a 15% common stock dividend when the market price of common shares was $23.50. On April 1, 2014, the company sold an additional 1,000,000 common shares for proceeds of $5,680,000. The corporation earned $722,000 during the year and paid $186,000 in dividends.

Instructions

a.. Calculate Peters Corporation's earnings per share for the year ended June 30, 2014, assuming the company paid $186,000 in cash dividends.

b. Calculate Peters Corporation's earnings per share for the year ended June 30, 2014, assuming the company paid $186,000 in cash dividends but there were no preferred dividends in arrears.

c. Calculate Peters Corporation's earnings per share for the year ended June 30, 2014, assuming the preferred dividends are noncumulative and $50,000 in total cash dividends were paid during the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: On January 1, 2014, the following information

Q120: The following information is available for a

Q121: At January 1, 2014, Morrisey Corporation had

Q122: The market price of Sanji's Paper Inc.'s

Q123: The following information is taken from the

Q125: On January 1, 2014, Grieve Grocers Inc.'s

Q126: At December 31, 2014, Sookie Limited has

Q127: Ahab Fisheries Inc. has authorized share capital

Q128: Groom Corporation had profit of $415,000 for

Q129: During 2014, the following independent events occurred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents