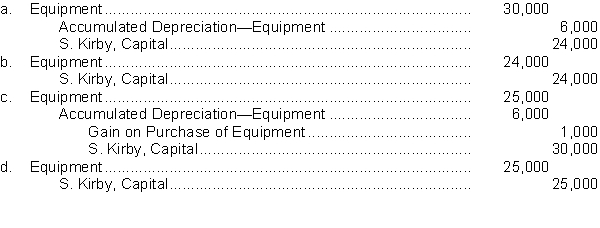

Sam Kirby invests personally owned equipment, which originally cost $30,000 and has accumulated depreciation of $6,000 in the Kirby and Gosse partnership. Both partners agree that the fair value of the equipment was $25,000. The entry made by the partnership to record Kirby's investment should be

Correct Answer:

Verified

Q68: At the end of December 2013, Rod

Q69: There are three accounting issues where there

Q70: Each partner's initial non-cash investment in the

Q71: If division of profits in a partnership

Q72: A partner contributes, as part of her

Q74: Which of the following statements about partnerships

Q75: All of the following are correct EXCEPT

A)

Q76: A profit ratio based on capital balances

Q77: Ms. Drew, Mr. Fraser and Ms. Percy

Q78: The profit of the Miskell and Leblanc

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents