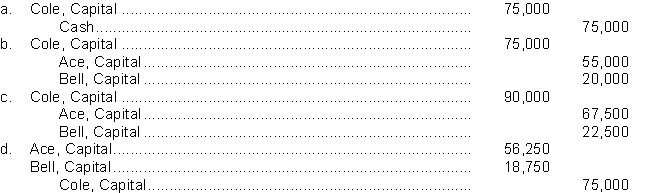

Ace, Bell, and Cole have partnership capital account balances of $90,000 each. Profit and losses are shared on a basis of 3:2:1 for Ace, Bell, and Cole respectively. Cole agrees to sell three-fourths of his ownership interest to Ace for $55,000 and one-fourth to Bell for $20,000. Ace and Bell will use personal assets to purchase Cole's interest. The partnership's entry to record Cole's withdrawal from the partnership would be

Correct Answer:

Verified

Q108: When a partner withdraws from the firm,

Q109: The partners' profit and loss sharing ratio

Q110: The partners' profit and loss sharing ratio

Q111: The investment of assets in a partnership

Q112: Partners A, B, and C have capital

Q114: When admitting a new partner by investment,

Q115: In the liquidation of a partnership, any

Q116: When admitting a new partner by investment,

Q117: If a partner has a capital deficiency

Q118: Accounting for the admission of a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents