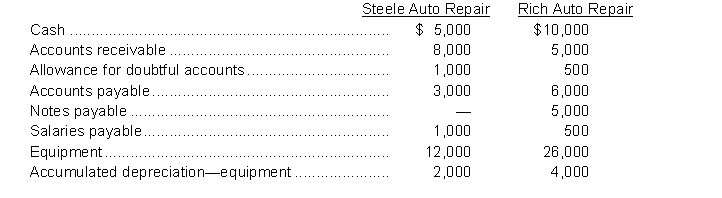

Jim Steele and John Rich operate separate auto repair shops as proprietorships. On January 1, 2014, they decide to combine their separate businesses to form Steele Rich Auto Repair, a partnership. Information from their separate balance sheets is presented below:  It is agreed that the expected realizable value of Steele's accounts receivable is $5,000 and Rich's receivables is $4,000. The fair value of Steele's equipment is $15,000 and Rich's equipment is $24,000. It is further agreed that the new partnership will assume all liabilities of the proprietorships with the exception of the notes payable on Rich's balance sheet which he will pay himself.

It is agreed that the expected realizable value of Steele's accounts receivable is $5,000 and Rich's receivables is $4,000. The fair value of Steele's equipment is $15,000 and Rich's equipment is $24,000. It is further agreed that the new partnership will assume all liabilities of the proprietorships with the exception of the notes payable on Rich's balance sheet which he will pay himself.

Instructions

Prepare the journal entries necessary to record the formation of the partnership.

Correct Answer:

Verified

Q101: The liquidation of a partnership

A) cannot be

Q123: A capital deficiency exists when

A) two or

Q124: Max Baer and Jimmy Choo are two

Q125: In the final step of the liquidation

Q127: On January 1, 2013, Steve Furlong and

Q129: Pac-link Technologies is a partnership owned and

Q130: Julie Harris, William Gosse, and Regina Ryan

Q131: Three types of partnerships were described in

Q132: Marty Cummerford and Jane Wheeler have formed

Q133: The condensed, adjusted trial balance of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents