Julie Harris, William Gosse, and Regina Ryan started a partnership to provide mobile tax services. The partners' capital account at the beginning of 2014 was Harris, $120,000; Gosse, $180,000; and Ryan, $90,000. The partnership agreement states that the partners will share profit equally.

On December 31, 2014, the partnership reported a loss of $21,000 for the year. During the year, Harris withdrew $80,000 and Gosse withdrew $140,000. Ryan did not make any withdrawals.

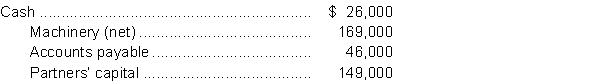

On January 1, 2015, the partners had a major disagreement as to the direction of the partnership and decided to liquidate the business. The December 31, 2014 balance sheet showed the following balances:  On January 1, 2015, the machinery was sold for proceeds of $133,000.

On January 1, 2015, the machinery was sold for proceeds of $133,000.

Instructions

Prepare the journal entry to record the following:

a. The allocation of the loss to the partners on December 31, 2014.

b. The closing of the drawings accounts on December 31, 2014.

c. The liquidation of the partnership on January 1, 2015.

Correct Answer:

Verified

Q101: The liquidation of a partnership

A) cannot be

Q103: In the liquidation process if a capital

Q125: In the final step of the liquidation

Q127: On January 1, 2013, Steve Furlong and

Q128: Jim Steele and John Rich operate separate

Q129: Pac-link Technologies is a partnership owned and

Q131: Three types of partnerships were described in

Q132: Marty Cummerford and Jane Wheeler have formed

Q133: The condensed, adjusted trial balance of the

Q135: The liquidation of a partnership is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents