A number of unrelated transactions recorded by Provincial Company are as follows:

1. At the end of the month, the obsolete inventory was valued at $17,000. No entry was made.

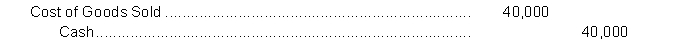

2. Provincial, which owns an art gallery, purchases a valuable painting for $40,000 in November, and sells it in January, which is after the company's year end. The entry made when the painting is purchased is:

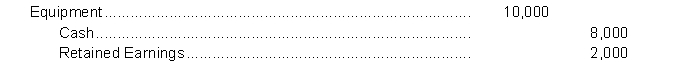

3. Equipment was purchased for $8,000 from a store that is going out of business. The equipment was appraised at $10,000.  Instructions

Instructions

For each of the above situations, identify the accounting assumption, concept, constraint or recognition criteria that have been violated. Prepare the correct journal entry as it should have been made. If no entry should have been made, or if additional financial statement disclosure is required, explain.

Correct Answer:

Verified

Q100: At the time of acquisition, long-lived assets

Q101: Instructions

For each item below, indicate the area

Q102: The following are independent situations observed by

Q103: For each of the independent situations described

Q104: In the following transactions, indicate when revenue

Q106: The following are independent situations observed by

Q107: A number of unrelated transactions recorded by

Q108: There are several ways the recognition and

Q109: Shediac Bay Sailing Inc. sold $175,500 of

Q110: Presented below are some business transactions that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents