The following unadjusted balances are taken from the trial balance of Jackson Equipment at December 31, 2014:  Jackson Equipment sells and installs security systems. Beginning on December 1, 2014, Jackson began offering a 2-year product warranty. Based on research in the industry, Jackson's management believes that 5% of security systems will require some warranty work and that the typical costs for systems requiring warranty work will be $875 during the first year and $325 during the second year. In December, Jackson supplied and installed 80 systems.

Jackson Equipment sells and installs security systems. Beginning on December 1, 2014, Jackson began offering a 2-year product warranty. Based on research in the industry, Jackson's management believes that 5% of security systems will require some warranty work and that the typical costs for systems requiring warranty work will be $875 during the first year and $325 during the second year. In December, Jackson supplied and installed 80 systems.

Instructions

a. Calculate and record Jackson's warranty liability at December 31, 2014.

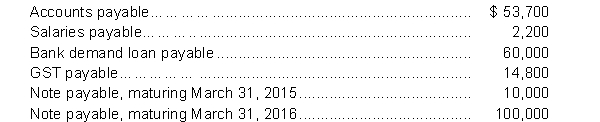

b. Prepare the current liability portion of Jackson's balance sheet at December 31, 2014.

Correct Answer:

Verified

80 syst...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Under ASPE, a contingency that is NOT

Q78: Under ASPE, only _contingent losses are recognized.

A)

Q79: Product warranties are promises made by the

Q80: Disclosure of a contingent loss is usually

Q81: The relationship of current assets to current

Q83: Milner Company is preparing adjusting entries at

Q84: Muffin Company issued a five-year, interest-bearing note

Q85: Duane Herman sells exercise machines for home

Q86: During April 2014, DMZ Company incurred the

Q87: Under ASPE, Current Liabilities are usually listed

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents