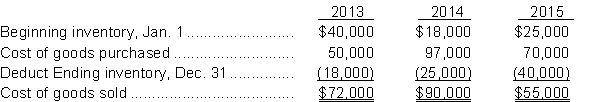

O'Neil's Hardware Store, in St. John's, NL, prepared the following analysis of cost of goods sold for the previous three years:  Profit for the years 2013, 2014, and 2015 was $83,000, $32,000, and $67,000, respectively. Since income had declined so much from 2013 to 2015, Mr. O'Neil hired a new accountant to investigate the cause(s) for the declines.

Profit for the years 2013, 2014, and 2015 was $83,000, $32,000, and $67,000, respectively. Since income had declined so much from 2013 to 2015, Mr. O'Neil hired a new accountant to investigate the cause(s) for the declines.

The accountant determined the following:

1. Purchases of $42,000 that occurred in 2013 were not recorded until 2014.

2. The December 31 2013 inventory should have been $23,000.

3. The 2014 ending inventory included inventory costing $6,000 that was purchased FOB destination point and was in transit at year end.

4. The 2015 ending inventory did not include goods costing $3,000 that were shipped on December 29 to Rosewell Plumbing Company, FOB shipping point. The goods were still in transit at the end of the year.

Instructions

Determine the correct income for each year. (Show all calculations.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q145: The controller of Lawn-Man Company is applying

Q146: Kersawani Company uses the perpetual inventory system

Q147: O'Meara Sales sells golf bags and uses

Q148: Fyodorov Company, using a periodic inventory system,

Q149: Bermuda Beach Boutique Company uses a perpetual

Q151: For each of the independent events listed

Q152: Winston Auto Parts reported the following information

Q153: Chan Pharmacy reported cost of goods sold

Q154: Hamil Company prepares monthly financial statements and

Q155: Walters Department Store uses the retail inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents