The new accountant for Wilson's Giftware was in a hurry to record the transactions for the month of March, and made the following errors:

1. February utilities of $560 had been recorded as an Account Payable in February. When the account was paid in March, the accountant recorded the payment as a debit to Utilities Expense and a credit to Cash.

2. March 15th salaries totalling $4,750 were recorded as a debit to Supplies instead of to Salaries Expense.

3. A customer payment in the amount of $1,200 was credited to Accounts Receivable. However the sale had never been invoiced or recorded and was a cash sale.

4. Samra Wilson withdrew $800 for personal use. The accountant recorded the entry as a debit to Cash and a credit to S. Wilson, Drawings.

Instructions:

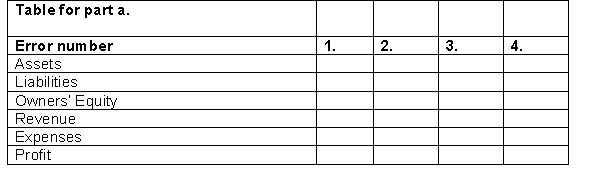

a. For each of the four errors, indicate the effect of the error on the balance sheet and income statement, indicating whether the assets, liabilities, owner's equity, revenue, expenses, and Profit are overstated (O), understated (U), or not affected (NA). Use the table below for your answer.

b. For each of the four errors, prepare the correcting entries required at March 31.

Correct Answer:

Verified

Q131: Instructions

Beside each step determine if the step

Q132: The following items are taken from the

Q133: The following lettered items represent a classification

Q134: The following information is available for Juxton

Q135: Below is an adjusted trial balance.

Q137: When preparing the December 31 year-end financial

Q138: The adjusted trial balance for DVD Concepts

Q139: The trial balances of Grant Company follow

Q140: Expo Company prepared the following adjusting entries

Q141: On August 31, 2014 selected accounts of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents