Each of the following independent situations represents a departure from generally accepted accounting principles:

1. Value Properties owns a number of apartment buildings. In April 2013 a new building was purchased for $1,000,000. Because of the rapid increase in real estate prices, by the time Value's accountant recorded the purchase in July 2013, the estimated value of the property had increased to $1,200,000. The accountant decided to record the new building at $1,200,000.

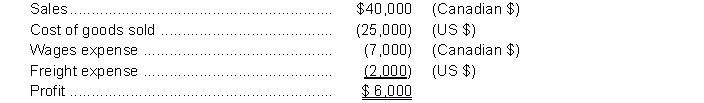

2. Expat Imports International purchases products in the United States for resale in Canada. The goods they buy in the US are paid for in US dollars. In Expat's financial statements, each amount is identified as being in either US or Canadian dollars, for example as follows:  Instructions

Instructions

For each situation, (i) identify which principle has been violated, (ii) describe what the correct accounting treatment would be, and (iii) why the correct treatment provides better information.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q137: The following are six questions that users

Q138: Jamenac Company recently released its first set

Q139: Jackson's Small Engine Repair Shop, a proprietorship,

Q140: The following transactions represent part of the

Q141: A service proprietorship shows five transactions summarized

Q143: Selected transactions for Givens Lawn Services are

Q144: Ken Serratore decides to open a cleaning

Q145: Analyze the transactions described below and indicate

Q146: What is meant by the cost principle?

Q147: Greg Stewart was reviewing his business activities

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents