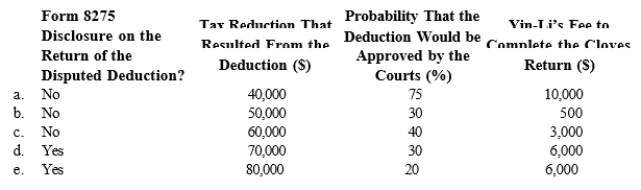

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q153: The IRS national office is organized into

Q154: Compute the undervaluation penalty for each

Q155: For each of the indicated tax penalties,

Q156: A tax professional needs to know how

Q157: For each of the indicated tax penalties,

Q159: For each of the indicated tax penalties,

Q160: What are the chief responsibilities of the

Q161: Attorneys are allowed an attorney-client privilege of

Q162: To whom do the AICPA's Statements on

Q163: Some taxpayers must make quarterly estimated payments

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents