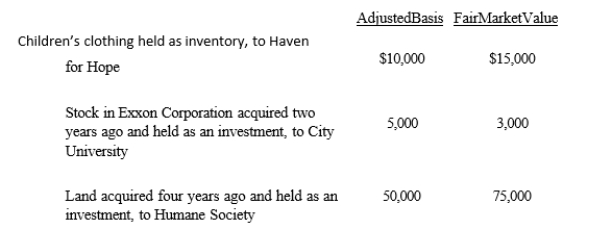

Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations this year.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of these.

Correct Answer:

Verified

Q63: In the current year, Red Corporation (a

Q64: Grebe Corporation, a closely held corporation that

Q65: Grackle Corporation, a personal service corporation, had

Q66: Beige Corporation, a C corporation, purchases a

Q67: Kingbird Corporation (a calendar year C

Q69: Wanda is the Chief Executive Officer

Q70: Which of the following statements is incorrect

Q71: Copper Corporation, a calendar year C corporation,

Q72: Orange Corporation, a calendar year C corporation,

Q73: Eagle Corporation, a calendar year C corporation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents