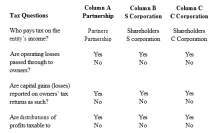

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C

corporation. Circle the correct answers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Aaron is the sole shareholder and CEO

Q40: Alicia is the sole shareholder and CEO

Q41: Which of the following taxpayers is eligible

Q42: Which of the following self-employed individuals are

Q44: Taylor owns a wide variety of commercial

Q45: Sergio Fernandez owns and manages his single-member

Q46: Rebecca and Brad are married and will

Q47: Which of the following taxpayers is potentially

Q48: Susan, a single taxpayer, owns and operates

Q64: Qualified business income includes the reasonable compensation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents