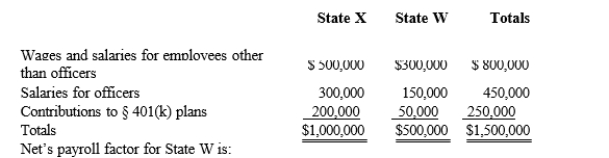

Net Corporation's sales office and manufacturing plant are located in State X. Net also maintains a manufacturing plant and sales office in State W. For purposes of apportionment, State X defines payroll as all compensation paid to employees, including contributions to § 401k) deferred compensation plans. Under State W's statutes, neither compensation paid to officers nor contributions to § 401k) plans are included in the payroll factor. Net incurred the following personnel costs:

A) 50.00%.

B) 37.50%.

C) 33.33%.

D) 0.00%.

Correct Answer:

Verified

Q61: Britta Corporation's entire operations are located in

Q62: The throwback rule requires that:

A) Sales of

Q65: General Corporation is taxable in a number

Q70: Bert Corporation, a calendar year taxpayer, owns

Q72: José Corporation realized $900,000 taxable income

Q76: Valdez Corporation, a calendar year taxpayer, owns

Q77: Ting, a regional sales manager, works

Q78: Given the following transactions for the

Q79: Trayne Corporation's sales office and manufacturing plant

Q80: Helene Corporation owns manufacturing facilities in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents