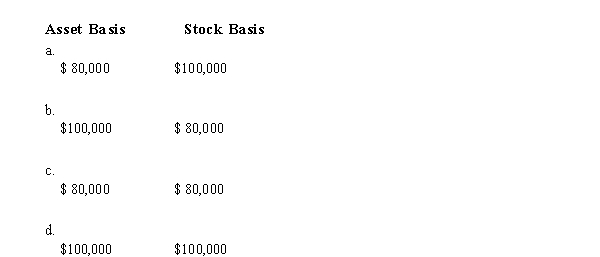

Chen contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a C corporation and the transaction qualifies under § 351, the corporation's basis for the property and the shareholder's basis for the stock are:

Correct Answer:

Verified

Q51: Match the following attributes with the different

Q52: Ruchi contributes property with an adjusted basis

Q53: Match the following attributes with the different

Q54: Alice contributes equipment fair market value of

Q55: Albert's sole proprietorship owns the following assets.

Q57: Match the following statements.

-Sale of corporate stock

Q58: Catfish, Inc., a closely held corporation

Q59: Match the following attributes with the different

Q60: Match the following statements.

-Sale of corporate stock

Q61: Match the following statements.

-S corporations

A)Usually subject to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents