ParentCo and SubCo report the following items of income and deduction for the current year. ParentCo's SubCo's Taxable Item Taxable Income Income Income loss) from operations $100,000 $10,000)

§ 1231 loss 5,000)

Capital gain 15,000

Charitable contribution 12,000

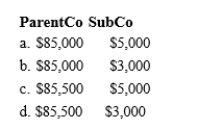

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Correct Answer:

Verified

Q70: ParentCo and SubCo report the following items

Q71: One of the motivations for the consolidated

Q72: ParentCo and SubCo recorded the following

Q73: ParentCo, SubOne, and SubTwo have filed

Q74: ParentCo and SubCo recorded the following items

Q76: SubCo sells an asset to ParentCo at

Q77: Which of the following items is not

Q78: ParentCo's separate taxable income was $200,000, and

Q79: ParentCo purchased all of the stock of

Q80: Subsidiary holds an allocated net operating loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents