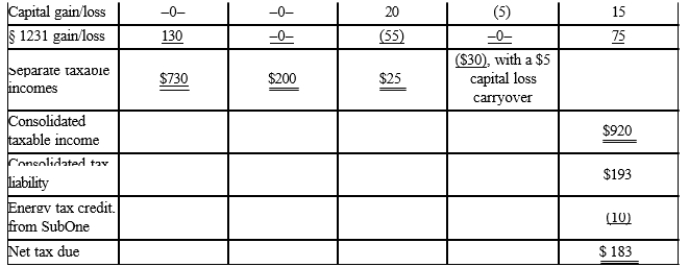

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that the members all have consented to use the relative tax liability tax-sharing method. Dollar amounts are listed in millions, and a 21% income tax rate applies to all of the entities.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: List some of the nontax reasons that

Q135: Match each of the following items with

Q136: Match each of the following items with

Q137: For each of the indicated tax

Q138: In the current year, Parent Corporation provided

Q140: Calendar year Parent Corporation acquired all

Q141: When a corporate group elects to file

Q142: Discuss how a parent corporation computes its

Q143: Describe the general computational method used by

Q144: Gold and Bronze elect to form a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents