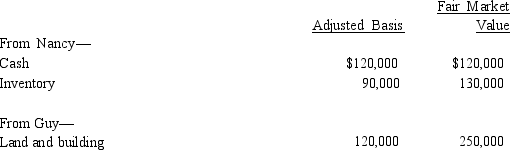

Nancy, Guy, and Rod form Goldfinch Corporation with the following consideration.

From Rod-

Legal and accounting services to incorporate

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy, 200 to Guy, and 50 to Rod. In addition, Guy gets

$50,000 in cash.

a. Does Nancy, Guy, or Rod recognize gain or income)?

b. What basis does Guy have in the Goldfinch stock?

c. What basis does Goldfinch Corporation have in the inventory? In the land and building?

d. What basis does Rod have in the Goldfinch stock?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Art, an unmarried individual, transfers property (basis

Q84: Lynn transfers property (basis of $225,000 and

Q86: Stock in Merlin Corporation is held equally

Q88: When Pheasant Corporation was formed under §

Q94: Tan Corporation desires to set up a

Q94: Ashley, a 70% shareholder of Wren Corporation,

Q95: Perry organized Cardinal Corporation 10 years ago

Q99: Jane and Walt form Yellow Corporation. Jane

Q102: For transfers falling under § 351, what

Q104: When forming a corporation, a transferor-shareholder may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents