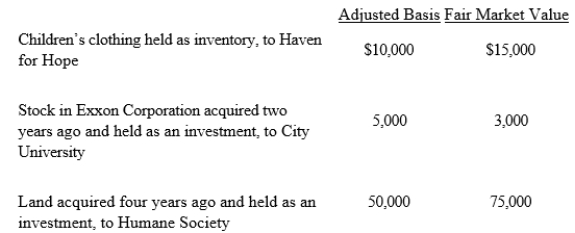

Owl Corporation a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations this year.  How much qualifies for the charitable contribution deduction ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of these.

Correct Answer:

Verified

Q22: Katherine, the sole shareholder of Penguin Corporation,

Q33: A calendar year C corporation can receive

Q40: A corporation must file a Federal income

Q46: Ivory Corporation, a calendar year, accrual method

Q51: On December 31, 2019, Peregrine Corporation, an

Q58: Copper Corporation, a C corporation, had gross

Q61: Violet, Inc., a closely held corporation (not

Q66: Beige Corporation, a C corporation, purchases a

Q75: For tax years ending after 2017, which

Q78: Woodchuck, Inc., a closely held personal service

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents