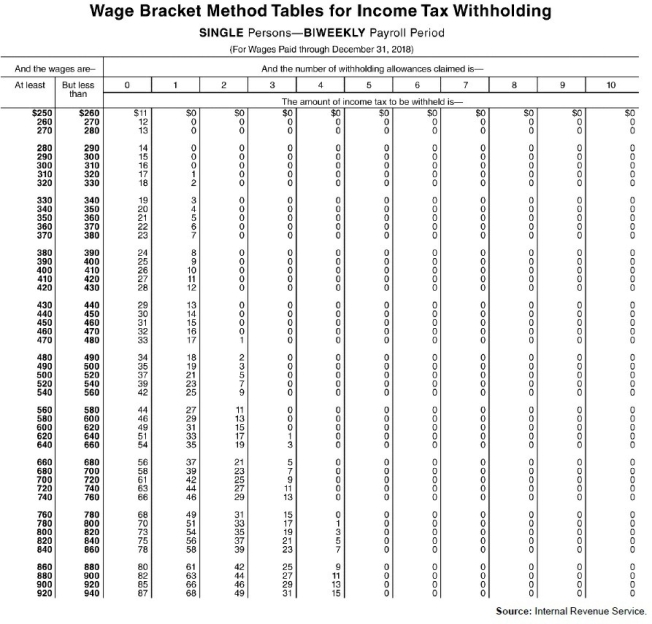

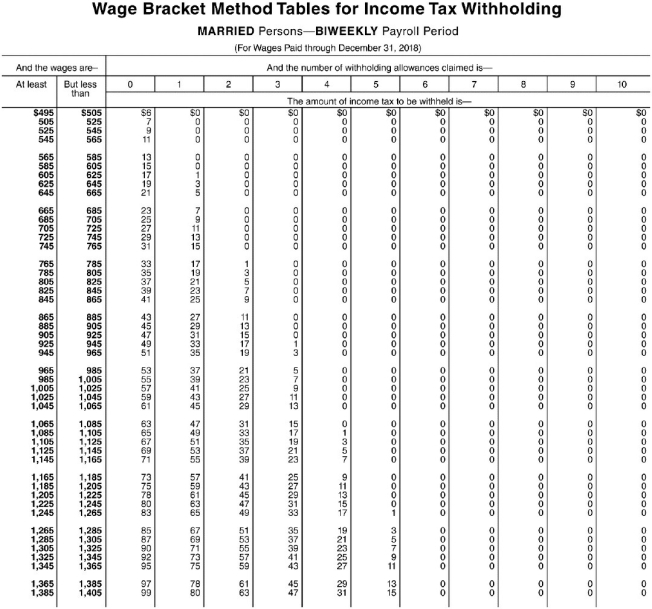

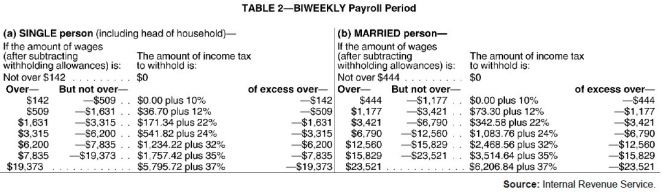

Exhibit 4-1:

Use the following tables to calculate your answers.

-Refer to Exhibit 4-1.Mary Matthews made $950 during a biweekly pay period only social security fully taxable) and federal income taxes attach to her pay.Matthews contributes $100 each biweekly pay to her company's 401k.Determine Matthews take home pay if she is married and claims 2 allowances.Use Wage Bracket Method)

Correct Answer:

Verified

Q21: Which of the following noncash fringe benefits

Q22: A person holding two jobs may have

Q31: For state income tax purposes, all states

Q39: An employee submits an invalid Form W-4

Q43: Exhibit 4-1:

Use the following tables to calculate

Q45: Exhibit 4-1:

Use the following tables to calculate

Q46: Exhibit 4-1:

Use the following tables to calculate

Q54: An employer must file an information return

Q57: To curb the practice of employees filing

Q58: Beech refuses to state her marital status

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents