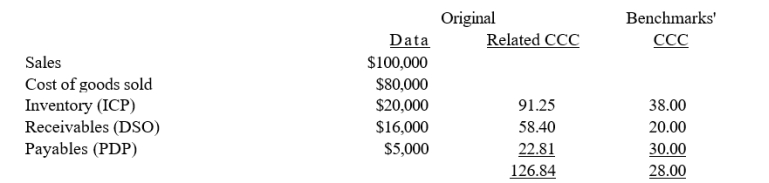

Soenen Inc. had the following data for 2013 (in millions). The new CFO believes that the company could improve its working capital management sufficiently to bring its net working capital and cash conversion cycle up to the benchmark companies' level without affecting either sales or the costs of goods sold. Soenen finances its net working capital with a bank loan at an 8% annual interest rate, and it uses a 365-day year. If these changes had been made, by how much would the firm's pre-tax income have increased?

B) $2,092

C) $2,301

D) $2,531

E) $2,784

Correct Answer:

Verified

Q101: Suppose the credit terms offered to your

Q102: A firm buys on terms of 3/15,net

Q103: Atlanta Cement,Inc.buys on terms of 2/15,net 30.It

Q106: Roton Inc.purchases merchandise on terms of 2/15,net

Q107: Your company has been offered credit terms

Q116: A firm buys on terms of 2/8,net

Q119: Affleck Inc.'s business is booming,and it needs

Q120: Margetis Inc.carries an average inventory of $750,000.Its

Q121: Gonzales Company currently uses maximum trade credit

Q123: Zarruk Construction's DSO is 50 days (on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents