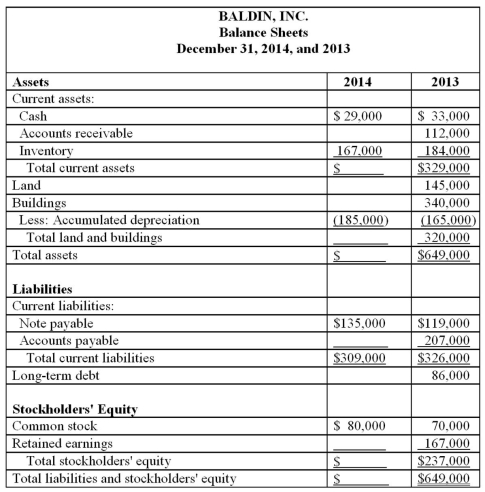

Presented below is a partially completed balance sheet for Baldin, Inc., at December 31, 2014, together with comparative data for the year ended December 31, 2013. From the Statement of Cash Flows for the year ended December 31, 2014, you determine that:

• Net income for the year ended December 31, 2014, was $106,000.

• Dividends paid during the year ended December 31, 2014, were $42,000.

• Accounts receivable increased $14,000 during the year ended December 31, 2014.

• The cost of new buildings acquired during 2014, was $85,000.

• No buildings were disposed of during 2014.

• The land account was not affected by any transactions during the year, but the fair value of the land at December 31, 2014, is $210,000.  Required:

Required:

(a.) Complete the December 31, 2014, balance sheet.

(b.) Prepare a statement of cash flows for the year ended December 31, 2014.

Correct Answer:

Verified

Q9: Which of the following accounts/captions are not

Q12: In the statement of cash flows, depreciation

Q15: The gross profit ratio is useful to

Q16: An item that cost $240 is to

Q19: When the periodic inventory system is used:

A)

Q22: Use the appropriate information from the

Q23: Gwinnett Park Co. reported net income of

Q24: Use the appropriate information from the

Q25: Norman's Cabinet, Inc., had net income of

Q27: The term "earned" in revenue recognition refers

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents