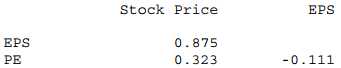

Shown below is a correlation table showing correlation coefficients between stock price, earnings per share (EPS) and price/earnings (P/E) ratio for a sample of 19 publicly traded companies.Which of the following statements is false?

Correlations: Stock Price, EPS, PE

A) EPS is the best predictor of stock price.

B) The strongest correlation is between EPS and stock price.

C) There is a weak negative association between PE and EPS.

D) PE is the best predictor of stock price.

E) The weakest correlation is between PE and EPS.

Correct Answer:

Verified

Q1: Linear regression was used to describe the

Q2: A company studying the productivity of its

Q4: Data were collected on monthly sales revenues

Q6: A consumer research group examining the relationship

Q7: Based on the following residual plot, which

Q8: A small independent organic food store offers

Q9: A company studying the productivity of their

Q10: A small independent organic food store offers

Q11: For the following scatterplot, Q18: A supermarket chain gathers data on the![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents