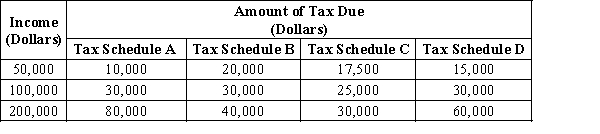

Table 12-3

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-3. For an individual with $200,000 in taxable income, which tax schedule has the lowest average tax rate?

A) Tax Schedule A

B) Tax Schedule B

C) Tax Schedule C

D) Tax Schedule D

Correct Answer:

Verified

Q178: As tax laws become more complex,

A)the administrative

Q179: The U.S. income tax

A)discourages saving.

B)encourages saving.

C)has no

Q180: Why do some policymakers support a consumption

Q181: Suppose that the government taxes income in

Q182: Suppose the government imposes a tax of

Q184: Scenario 12-3

A taxpayer faces the following

Q185: If the government imposes a tax of

Q186: If your income is $40,000 and your

Q187: If your income is $40,000 and your

Q188: In the United States, the marginal tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents