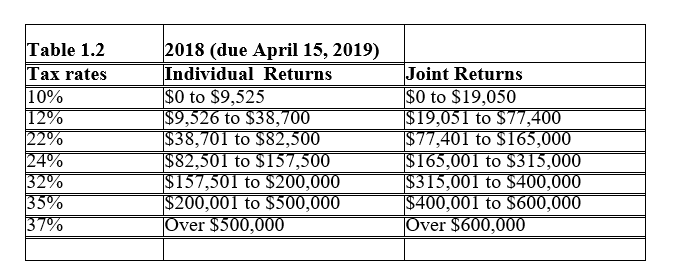

-In 2018, Jordan and Kailey earned a combined taxable income of $148,800 from employment plus $1,000 in long term capital gains and they file a joint tax return. What is their total federal income tax? Round to the nearest dollar.

A) $33,780

B) $29,063

C) $24,765

D) $24,659

Correct Answer:

Verified

Q38: Mutual funds invest in diversified portfolios of

Q39: Under current tax laws, most taxpayers will

Q40: A collection of securities designed to meet

Q41: Under current laws, a couple filing jointly

Q42: Because Doug lost his job in 2018,

Q44: Investors can postpone or avoid income taxes

Q45: Michelle and Patrick are in the 24%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents