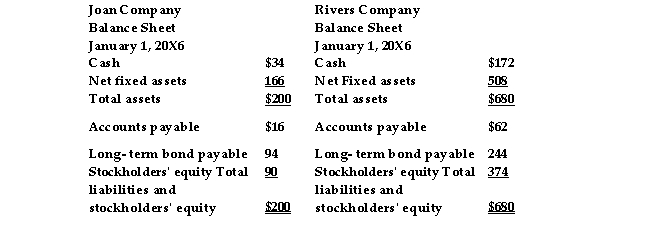

On January 1, 20X6, Rivers Company acquired 80% of the outstanding shares of common stock of Joan Company for $72. During 20X6, Joan Company had net income of $10, and Rivers Company had net income of

On January 1, 20X6, Rivers Company acquired 80% of the outstanding shares of common stock of Joan Company for $72. During 20X6, Joan Company had net income of $10, and Rivers Company had net income of

$40. None of the net income for either company was the result of intercompany sales. All net income for both companies is in the form of cash.

Prepare the following:

a. The consolidated balance sheet immediately after the acquisition

b. The elimination entry necessary on December 31, 20X6

c. The consolidated balance sheet at December 31, 20X6

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The parent-subsidiary relationship requires special accounting treatment.

Q13: When a company is acquired and becomes

Q19: Minority interests affect only the balance sheet

Q38: There is general agreement among most accountants

Q157: On January 1, 20X6, Meghan purchased 8,000

Q162: The following information pertains to Brady

Q163: Hawkeye Company began the current year with

Q164: Give reasons why a basic knowledge about

Q165: Given below is the income statement

Q166: Provided below are the comparative income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents