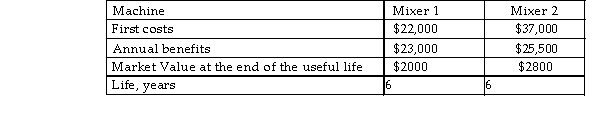

A construction company has an effective income tax rate of 39%. The company must purchase one of the following two cement mixers for its new project. The after- tax MARR is 10% per year. Select a cement mixer on the basis of after- tax present worth analysis using MACRS with a 5- year recovery period.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A plantation has purchased an automated propagation

Q3: ADD Systems Corp. reported a gross income

Q6: A coil winding and unwinding machine that

Q9: A Caribbean cruise line has purchased a

Q12: A petroleum refining and recovery service company,

Q14: A manufacturer of hardboard and fiber cement

Q16: A $22,000 flow measurement instrument was installed

Q17: A low- cost airline operating in South

Q20: A viscosity sensing instrument costs $46,000 and

Q25: A laboratory centrifuge costs $79,000 and has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents