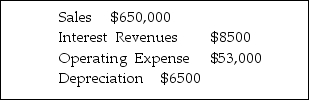

Seminole Lighting, a specialty lamps and specialty light sources manufacturer, had the following information on its annual tax returns. Determine Seminole's taxable income and calculate the federal income tax for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: A Caribbean cruise line has purchased a

Q12: A petroleum refining and recovery service company,

Q17: A low- cost airline operating in South

Q18: A machine used in the manufacture of

Q19: An uninterruptible power system used in a

Q20: Mountaineer Transportation, Inc. had the following information

Q21: A construction company has an effective income

Q23: An piece of automated assembly equipment has

Q24: A logistics company is deciding between two

Q25: A laboratory centrifuge costs $79,000 and has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents