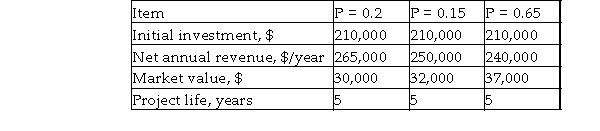

Kewpie, Inc. is considering purchasing a new set of packaging and labeling equipment. A comparison of estimated cash flows is shown below.  If straight- line depreciation with a salvage value of $32,000 and a useful life of 5 years is used, determine whether Kewpie should invest in the equipment on the basis of the expected value of after- tax PW. Assume an effective tax rate of 35% and a MARR of 10% per year.

If straight- line depreciation with a salvage value of $32,000 and a useful life of 5 years is used, determine whether Kewpie should invest in the equipment on the basis of the expected value of after- tax PW. Assume an effective tax rate of 35% and a MARR of 10% per year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The estimated annual cash flow of an

Q2: Gopher Manufacturing is considering purchasing new calibration

Q5: The probability distribution of a certain overhead

Q5: Amy wants to estimate the average number

Q6: Buffalo Manufacturing is considering purchasing new equipment

Q7: An engineer is considering the size of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents